Engagement & Retention project | Rentomojo

Core Value Proposition 🪑

Rentomojo offers the convenience of renting essential daily-use furniture, appliances, and vehicles, making it easier for users to access high-quality items without the commitment of ownership. Users can rent a wide range of products, including:

- Furniture: Study tables, chairs, sofas, dining sets, and more.

- Appliances: Everyday essentials such as washing machines, refrigerators, mobile phones, and laptops.

- Automobiles: Geared and non-geared two-wheelers, including both electric and petrol options.

User Experience 🙍♀️

- Personalized Combos: Relevant furniture and appliance bundles, categorized by room type and use-case (e.g., for bachelors, couples, or small families).

- Flexible Payment and Subscription Plans: Customizable payment plans, with options for different subscription lengths and rental durations.

- Maintenance and Support: Free item repair or exchange after a specified rental period, enhancing longevity and convenience.

- Relocation Support: Free relocation services for existing rentals.

- Transferable Rent-ship: Option to transfer an ongoing rental agreement to a new tenant if they wish to continue the same rental items.

Ideal Engagement Framework 🚀

To assess ideal engagement metrics for Rentomojo, we’ll use a three-part framework based on Frequency, Depth, and Breadth of user interactions with the platform.

- Frequency:

Although users experience the core rental service annually (the length of the typical rental duration), there are monthly interactions for rent payments. Therefore, while monthly visits drive engagement, the core value frequency centers around an annual cadence tied to rental renewals or adjustments. - Depth:

To measure depth of engagement, we consider two potential metrics: - Subscription Duration: Length of the user's subscription plan, reflecting commitment to long-term rentals.

- Items per Category: The number of items rented within a single category (e.g., furniture).

For Rentomojo, subscription duration is the primary depth metric, as it provides insight into customer loyalty and retention over time.

- Breadth:

Breadth measures the diversity of products rented. Possible metrics include: - Total Items Rented: Overall count of rented items.

- Distinct Categories Rented: Number of unique categories (e.g., furniture, appliances) rented by the user.

Here, total distinct items rented across categories is chosen to indicate the breadth of engagement, capturing how widely a customer utilizes Rentomojo’s offerings.

Active Users

An active user on Rentomojo is defined by specific actions that signify ongoing engagement with the platform, including:

- Rent Payment: Regular payment of monthly rent.

- Wallet Recharges: Adding money to the Rentomojo wallet.

- Timely Re-subscription: Renewing rental plans as soon as the current rental period ends.

The primary natural frequency for Rentomojo’s core product—rental engagement—is annual, aligned with the typical duration of rental agreements. However, monthly interactions occur due to recurring rent payments and wallet top-ups.

Engagement Metrics

Average Subscription Length

The average length of subscription provides insight into user retention and helps put Rentomojo’s acquisition efforts into perspective. Longer subscription terms indicate deeper engagement, minimize churn, and enhance overall customer lifetime value.

- Recurring Payments: Users with long-term subscriptions are more likely to engage with the platform frequently for rent payments, driving consistent website traffic.

- Reduced Logistics Costs: Longer subscriptions minimize the frequency of product deliveries and pickups, reducing logistics expenses for Rentomojo.

- Increased Word-of-Mouth: Satisfied long-term users are more likely to recommend Rentomojo, bolstering organic growth.

- Trust and Brand Perception: A longer subscription suggests that users view Rentomojo as a trusted brand, reinforcing brand loyalty.

Monthly Rent Payments

Monthly rent payments are directly tied to Rentomojo’s revenue stream. This metric correlates with the financial health of the user base and indicates the sustained value they derive from the platform.

Average Wallet Balance

The average amount users maintain in their Rentomojo wallet demonstrates their commitment to the platform. A higher wallet balance reflects users’ intent to stay engaged, at least until their funds are fully utilized.

Wallet Recharges (Last 6 Months)

The number of wallet recharges within the last six months indicates sustained engagement. Each recharge represents a recurring commitment to payments and generates additional website visits.

Number of Rent Re-subscriptions

Re-subscriptions reflect trust in Rentomojo’s product and service quality. Users who continue to renew their rentals show confidence in the platform, reinforcing customer satisfaction and brand reliability.

For Rentomojo, users are segmented based on their engagement level, usage characteristics, valued features, and overall needs. This detailed segmentation allows for a clear distinction between each user type, revealing specific needs and product interactions.

Type 1: Casual Users (Young Professionals) 🥱

Definition:

These users are typically young professionals, often bachelors or singles, who move frequently between cities. They usually have shorter stays in any given location and prioritize flexibility. Renting is a convenient, temporary solution that fits their lifestyle as they navigate career shifts and changing locations.

Usage Characteristics:

- Rents a limited number of items, typically 2-3.

- Mostly rents essentials like basic furniture (e.g., chair, table) and small appliances.

- Engages primarily with basic furniture or everyday essentials, with a low average order value (AOV).

Pain Points:

- Difficulty finding short-term, affordable rental options.

- Concerned with high commitment costs and logistics for moving items frequently.

- Durability and repair of items are key considerations due to potential wear from relocation.

Valued Features:

- Flexible, customizable rental periods to suit shorter stays.

- Return windows that accommodate frequent moves.

- Discounts on wallet usage to support cost-effectiveness.

Core Value Proposition Utilized:

- Ease of Renting: Provides a hassle-free way to access essential items on the go.

Discovery Channels:

- Primarily finds Rentomojo through SEO, Paid Ads, and Referrals from friends.

Type 2: Core Users (Mid-Career Professionals) 🤝

Definition:

These users are generally mid-career professionals, often couples or families with young children, who have settled in a city for the medium term (1-2 years). They value the flexibility of renting over purchasing to avoid high up-front costs, and they prioritize convenience due to potential relocations.

Usage Characteristics:

- Typically rents 2-3 items across 1-2 categories, including mid-tier products such as beds, refrigerators, and washing machines.

- Represents a moderate level of engagement, with higher AOV compared to Type 1 users.

- Interacts with a broader range of categories and higher-value essentials.

Pain Points:

- Concerned with the financial and logistical commitment of renting several items.

- Values options for durable, high-quality products to reduce frequent replacements and repairs.

Valued Features:

- Insurance and repair coverage for peace of mind.

- Discounts on wallet usage for affordability.

- Video previews for a clearer view of product quality and style.

Core Value Proposition Utilized:

- Wide Range of Categories: Access to essential items across multiple categories without a permanent commitment.

Discovery Channels:

- Similar to Type 1 (SEO, Paid Ads, Referrals) but also relies on Word of Mouth due to their active social circles.

Type 3: Power Users (Affluent, Established Professionals) 💪

Definition:

These are well-established, high-earning professionals, often married with young families. They have a stable lifestyle and are willing to invest in luxury and designer products to keep up with style trends. They view Rentomojo as a means to access premium items that enhance their living spaces without the need for long-term ownership.

Usage Characteristics:

- High engagement level, renting multiple items across more than two categories.

- Prefers premium and luxury products, such as designer furniture and branded appliances.

- Generates the highest revenue among user types due to a higher AOV.

Pain Points:

- Looking for customization and high-end styling options.

- Finds it challenging to create cohesive, customized combos for a designer aesthetic.

- Prefers options for variety, as static furniture items can become monotonous over time.

Valued Features:

- Customizable and designer furniture options.

- Ability to view items in-store, enabling hands-on experience before renting.

- Insurance and repair support to maintain the longevity of premium products.

Core Value Proposition Utilized:

- Designer Furniture: Access to stylish, on-trend furniture that enhances their living space.

Discovery Channels:

- Uses SEO, Paid Ads, Word of Mouth, but also appreciates in-store experiences to verify product quality and style.

Product Hook 1: End-of-Season Sales and Inventory Reduction

- Goal:

Reduce the size of Rentomojo's inventory to optimize space usage, minimize the impact of aging stock, and keep product offerings fresh and relevant. - Success Metric:

Number of new subscriptions driven by promotions on older or refurbished inventory. - Problem Statement:

Inventory takes up valuable space, and items left unsold become "dead assets" that are increasingly difficult to rent due to outdated styles or wear over time. - Current Alternatives:

Users may seek other rental apps, which often feature newer inventory and more fashionable options. Other alternatives include small, local rental stores, boutique shops (both online and offline), which may offer personalized or more trendy selections. - Solution Summary:

Implement seasonal sales, festive discounts, and bundle offers to promote older inventory, emphasizing discounts for combos and refurbished products. This incentivizes users to select items that help free up storage space while still providing functional and stylish rental options. - Solution - Detailed Version and User Flow:

- User Flow:

- Scenario 1: Open App -> "Deals of the Day" Feature Highlights Discounted Dead Inventory.

- Scenario 2: Open App -> New Subscription -> Show Bundled “Combos” Featuring Dead Inventory.

- Scenario 3: Open App -> New Subscription -> Suggest Alternate Items from Dead Inventory.

- User Experience:

- Users are encouraged to rent discounted products through enticing in-app placements like "Deals of the Day" or suggested combos during the subscription flow, effectively spotlighting older or slower-moving inventory.

- Metrics to Track:

- New subscriptions from discounted items or combos.

- Volume of dead inventory moved (items rented via discount promotions).

- Conversion rate on "Deals of the Day" and dead inventory recommendations.

- Ramp-up Milestones:

- Phase 1: Implement and test “Deals of the Day” placement for discounted items (first month).

- Phase 2: Integrate discounted combos in the subscription flow and analyze conversions (months 2-3).

- Phase 3: Conduct first end-of-season sale with older and refurbished items to maximize inventory reduction (quarterly or seasonal).

Product Hook 2: Wallet Recharge Incentive Program

- Goal:

Reduce the rate of late payments and defaults across all user segments by increasing the average wallet balance, thereby ensuring funds are committed for future payments. - Success Metric:

Growth in average wallet balance across all user types, indicating a greater buffer for recurring rent payments and less need for follow-ups or penalty fees. - Problem Statement:

High rates of payment defaults and late payments drive up customer support costs and create logistical burdens. Additionally, users are likely to prioritize discretionary expenses such as food delivery or lifestyle purchases over their rental payments. - Current Alternatives:

Without a wallet buffer, users often allocate funds elsewhere, leading to delayed or missed payments. - Solution Summary:

Encourage wallet recharges by offering discounts or platform-specific currency for larger top-ups. Incentivize paying rent in advance by offering a discount for bulk payments (e.g., "pay for three months, get 20% off"). - Solution - Detailed Version and User Flow:

- User Flow:

- Open App -> Monthly Payment Due -> Pay for One Month OR Pay 2.4x for Three Months (enjoying a 20% discount).

- Additional incentive to recharge wallet with platform-specific currency or wallet bonuses.

- User Experience:

- Users are motivated to recharge their wallet with discounts or platform rewards, creating a positive loop where committed funds reduce their likelihood of defaulting and result in a smoother rental experience.

- Metrics to Track:

- Average wallet size across user segments.

- Percentage reduction in late payments or defaults.

- Number of users opting for multi-month payments or wallet recharge offers.

- Ramp-up Milestones:

- Phase 1: Introduce wallet recharge incentives and track user adoption rates (first month).

- Phase 2: Monitor monthly payment patterns and identify impact on default rate (months 2-3).

- Phase 3: Scale incentive program by experimenting with different discount tiers and wallet bonus amounts to maximize pre-payment (quarterly or as needed).

Offers and Goal Types

We will be using the following Offer and Goals in different campaign structures. The selection will be based on the combination which will work the best for that campaign.

Offer Types:

- Type 1: One time x% Discount on the deposit amount

- Type 2: Flat x% discount on all the monthly payments

- Type 3: Add x money to your wallet and get 1.2x added to the wallet

- Type 4: Pay for 3 months in one go and we will add one month free to the subscription.

Goal Types:

- Type 1: Increase subscription lengths to increase commitment and retention

- Type 2: Increase revenue by driving new subscription rate

- Type 3: Reduce default rate and late payment rate by adding money to the wallet

Festive Sales Campaign

- Hypothesis: Festivals are a time of high consumer spending, often on home improvements due to increased guest activity. People are more likely to budget for new furniture or appliances during this period, creating a prime opportunity for rentals.

- Channel of Distribution: Physical (stores); Online (push notifications, social media ads, web ads, influencer marketing, email).

- User Characteristics: Family segment, core, and power users who have a tendency to spend around festive times and allocate budgets specifically for this period.

- Goal: Increase subscription rates by driving festive-season rentals.

- Pitch: "Bring home a new ___ this festive season.", "Mahmano ko sofe pe baithaiye, ye rented hai koi bata hi nahi sakta!" and similar catchy, festive-friendly messaging.

- Offer: Type 1 (One-time discount on deposit) and Type 2 (Flat monthly discount).

- Timing: October to December.

- Frequency: Once a week, targeting specific festivals.

Festive Sales Campaign Visual Flow

- Push Notification: Sent at 1 P.M., capturing attention during lunch hours.

- Notification Text: "Festive Special! Bring home a new sofa at discounted rates this Diwali!"

- User Action: User clicks on the notification, which opens the Rentomojo app with a festive-themed splash screen.

- Splash Screen Message: "Diwali Dhamaka! Special Offers Await - Celebrate the Festive Season in Style!"

- Redirect: User is taken to a dedicated “Festive Offers” page showcasing popular products with the seasonal discounts.

- Offer Display: Festive discounts are applied to items, with both Type 1 (one-time discount on deposit) and Type 2 (flat monthly discount) offers clearly indicated. Each product shows a festive-themed pricing structure:

- Example:

- Deposit:

₹800→ ₹650 - Monthly Rent:

₹200→ ₹150

- Deposit:

- Visuals & Copy: Festive-themed banners and product images with celebratory colors (e.g., maroons, golds) and Diwali-inspired motifs to reinforce the holiday spirit.

- Call to Action: Prominently displayed button with festive-themed copy like, “Celebrate with New Furniture” or “Shop Festive Deals Now.”

Seasonality Campaign (Stock Clearance)

- Hypothesis: August and September often see higher job changes, resulting in relocations, making it an ideal time for households to consider rental solutions.

- Channel of Distribution: Online (push notifications, social media ads, web ads, influencer marketing, email).

- User Characteristics: Casual and new users.

- Goal: Drive new subscriptions and increase rental commitments.

- Pitch: "Our stock is ending and but your comfort begins"

- Offer: Type 4 (Pay for 3 months, get one month free).

- Timing: August and September.

- Frequency: Once every fortnight.

Seasonality Campaign Visual Flow

- Push Notification: Sent around 6 P.M., targeting post-work hours.

- Notification Text: "Season-end Clearance! Stock up your home essentials with exclusive deals."

- User Action: User clicks on the notification, opening the app on a "Season Clearance Sale" splash screen.

- Splash Screen Message: "Special Clearance Sale - Limited Time Offers!"

- Redirect: User lands on a dedicated "Season Clearance Offers" page.

- Offer Display: Each product displays "Pay for 3 months, get 1 month free" pricing.

- Call to Action: “Start Saving Now”

WFH Campaign

- Hypothesis: With the rise of remote work, there’s high demand for ergonomic furniture (table and chairs) for home offices. Once a user rents basic items, they are more likely to add other essentials.

- Channel of Distribution: Online (push notifications, social media ads, web ads, influencer marketing, email).

- User Characteristics: Casual users, new joiners, users shifting to remote work.

- Goal: Increase revenue by adding new subscribers with Work-from-Home setups.

- Pitch: "Setting up your WFH space? Ergonomic furniture essentials now available for rent!"

- Offer: Type 1 (One-time discount on deposit) and Type 2 (Flat monthly discount).

- Timing: September and August.

- Frequency: Once every fortnight.

WFH Campaign Visual Flow

- Push Notification: Sent at 9 A.M., aiming for early-morning setup planning.

- Notification Text: "Get your WFH essentials at amazing discounts today!"

- User Action: User clicks the notification, opening the app with a WFH-themed splash screen.

- Splash Screen Message: "Boost Your Productivity at Home! Special WFH Deals Await."

- Redirect: User lands on a "WFH Essentials" offers page.

- Offer Display: Show products with discounted deposit and monthly rates.

- Call to Action: “Set Up Your Workspace Now”

Full House Furnishing Solution Campaign

- Hypothesis: Many users looking to furnish homes find the design and product selection process overwhelming; offering a full-house solution simplifies their experience.

- Channel of Distribution: Physical (stores); Online (push notifications, social media ads, web ads, influencer marketing, email).

- User Characteristics: Family and power users who prioritize convenience and style.

- Goal: Drive longer subscription lengths and increase commitment.

- Pitch: "No need to splurge on a designer! Just upload your details, and we’ll furnish your home to perfection."

- Offer: Type 4 (Pay for 3 months, get one month free).

- Timing: Year-round.

- Frequency: Once a month.

Full House Furnishing Solution Campaign Visual Flow

- Push Notification: Sent at noon, capturing lunch-time attention.

- Notification Text: "Furnish your entire home without the hassle! Explore full-house setups."

- User Action: User clicks to open a “Complete Your Home” themed splash screen.

- Splash Screen Message: "Full House Furnishing Solutions – Easy & Affordable!"

- Redirect: User is taken to a “Full House Solutions” page.

- Offer Display: Package offer of "Pay for 3 months, get 1 month free" applied across all listed full-house setups.

- Call to Action: “Furnish My Home”

Save 20% Campaign

- Hypothesis: Discounts can incentivize users to rent older inventory or dead stock items.

- Channel of Distribution: Physical (stores); Online (push notifications, social media ads, web ads, influencer marketing, email).

- User Characteristics: Core users looking for budget-friendly deals.

- Goal: Move dead inventory by offering compelling discounts.

- Pitch: "Limited-time Deal of the Day: Save big on select items!"

- Offer: Type 1 (One-time discount on deposit) and Type 2 (Flat monthly discount).

- Timing: August and September.

- Frequency: Once every fortnight.

Save 20% Campaign Visual Flow

- Push Notification: Sent at 4 P.M., capturing mid-day attention.

- Notification Text: "Deal of the Day: 20% off on select items, while stocks last!"

- User Action: User clicks, opening an app splash screen highlighting the discount.

- Splash Screen Message: "Big Savings on Select Items – Limited Time Only!"

- Redirect: User is taken to the "Deal of the Day" page.

- Offer Display: Each item includes striked-through deposit and rent with the 20% discount applied.

- Call to Action: “Shop Deals Now”

Third-Party Integration Campaign

- Hypothesis: Partnering with property rental platforms can increase Rentomojo’s visibility to users in need of home furnishings for new spaces.

- Channel of Distribution: Online (web ads on third-party platforms like NoBroker, MyGate).

- User Characteristics: Casual, core, and power users discovering rental needs through property platforms.

- Goal: Increase revenue by driving new subscriptions.

- Pitch: "Rent your home essentials with exclusive discounts for NoBroker customers!"

- Offer: Type 1 (One-time discount on deposit) and Type 3 (wallet top-up bonus).

- Timing: Year-round.

- Frequency: Ongoing.

Third-Party Integration Campaign Visual Flow

- Web Ads: Integrated on platforms like NoBroker and MyGate.

- Ad Text: "New Home? Get Rentomojo Essentials with Exclusive Discounts!"

- User Action: User clicks ad, redirecting to Rentomojo’s offer page.

- Offer Display: Discounts highlighted based on Type 1 and Type 3 offers (e.g., wallet top-up bonus).

- Call to Action: “Furnish My Space”

Upgrade Your Product Campaign

- Hypothesis: Users nearing the end of their rental period may wish to refresh or upgrade their furnishings, preventing monotony and catering to changing needs.

- Channel of Distribution: Online (push notifications, social media ads, web ads, influencer marketing, email).

- User Characteristics: Casual, core, and power users nearing the end of their subscription.

- Goal: Increase subscription lengths by encouraging upgrades.

- Pitch: "Time to upgrade! Refresh your space with our latest styles and designs."

- Offer: Type 2 (Flat discount on monthly payments).

- Timing: Year-round.

- Frequency: Once a month.

Upgrade Your Product Campaign Visual Flow

- Push Notification: Sent at the end of the month, encouraging an upgrade.

- Notification Text: "Ready for a change? Upgrade to our latest styles at discounted rates!"

- User Action: User clicks, landing on an "Upgrade Your Space" splash screen.

- Splash Screen Message: "Refresh Your Home – New Looks, Exclusive Deals!"

- Redirect: User is taken to the "Upgrade" page.

- Offer Display: Type 2 discounts applied to upgraded items.

- Call to Action: “Upgrade Now”

Pay-Day Campaign

- Hypothesis: At the beginning of each month, users are more likely to spend, driven by salary influx and higher purchasing power.

- Channel of Distribution: Online (push notifications, social media ads, web ads, influencer marketing, email).

- User Characteristics: Casual, core, and power users who are typically inclined to make purchases after payday.

- Goal: Increase revenue by driving subscriptions.

- Pitch: "Payday special: Get your essentials at exclusive rates!"

- Offer: Type 3 (wallet top-up bonus).

- Timing: First week of each month.

- Frequency: Twice in the first week.

Pay-Day Campaign Visual Flow

- Push Notification: Sent on the 1st of the month at 10 A.M., encouraging spending post-payday.

- Notification Text: "Cha-Ching! Treat yourself to new furniture this month."

- User Action: User clicks, opening a payday-themed splash screen.

- Splash Screen Message: "Fresh Month, Fresh Deals – Get 20% More on Wallet Top-Ups!"

- Redirect: User lands on the “Payday Offers” page.

- Offer Display: Type 3 offer details, showing bonus wallet top-ups.

- Call to Action: “Top Up My Wallet”

Making Sense of the Data

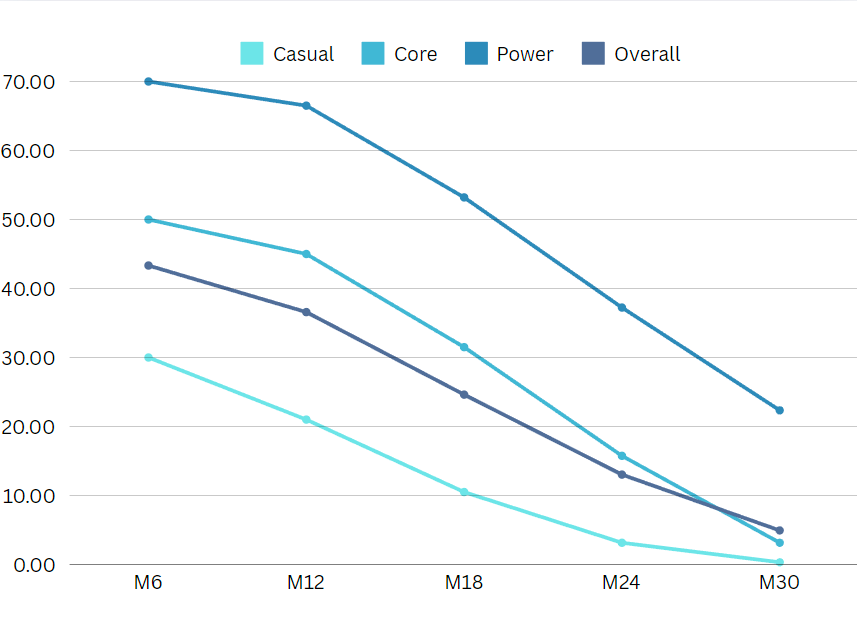

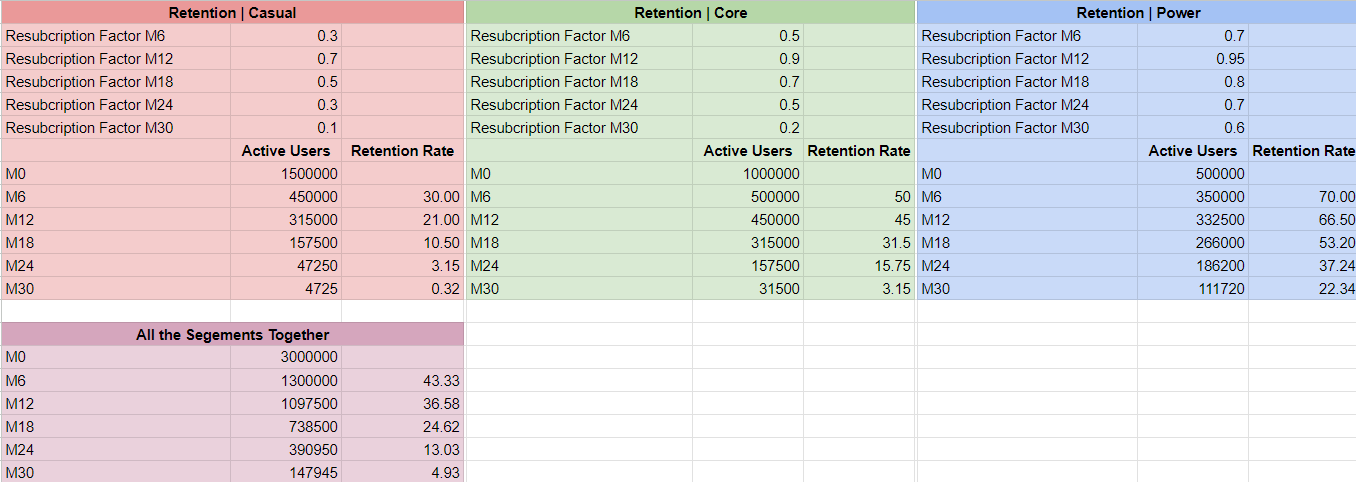

First let us plot the Overall Retention Curve along with Segment wise retention curves.

The Y-Axis is the Retention Percentage and the X-Axis is the time (Month 6, 12, 18, 24, 30)

We can draw the following inferences from the Table and the Graphs

- There is good drop-out of Users at the Month 6 mark across all the segments, these are the users who tried the product and churned after a single trial, deciding renting is not their cup of tea.

- The is a high resubscription rate in M12 transition window. These customers have experienced the true core value proposition of the renting business model and continue their subscription.

- After M12 there is gradual increase in the Churn Rate of the users. This is the window when the total money spent on rent starts competing with the actual of cost of buying the product and users keep churning eventually buying the product of their need.

Retention-Driving ICPs

The power users form the most retention-heavy Ideal Customer Profile (ICP) for Rentomojo. This group primarily rents high-value items, achieving the best retention due to several key factors:

- Value Efficiency: Since they rent high-ticket items, the monthly rent relative to the actual price of these items is low, providing a higher perceived value.

- Commitment to Platform: Power users often require a long-term rental commitment, driving repeat interactions and increased loyalty to the service.

- Predictive Indicators: A consistently high wallet balance among these users predicts retention, as it indicates intent to continue renting over a longer duration.

Effective Acquisition Channels

The Word-of-Mouth (WOM) and organic acquisition channels have been identified as the most retention-heavy. Users acquired through these channels demonstrate the highest stickiness, likely due to trust from friend or family recommendations and a deeper initial buy-in to Rentomojo’s unique value proposition. In contrast, users acquired through paid social media ads show the highest churn rates, indicating a need to balance acquisition quality and quantity.

Retention-Driven Features and Sub-Products

Sub-features and sub-products that drive retention effectively are those related to financial security and payment convenience:

- High Average Wallet Amount: Users with a higher average wallet amount are more likely to stay engaged, as they demonstrate a financial commitment to future transactions.

- Timely Payment History: Users who consistently make timely payments have a medium-to-long retention window, signaling both satisfaction with the service and a reliable engagement pattern.

- Product Add-Ons: Adding additional rental features (e.g., insurance or maintenance coverage) reinforces retention by ensuring users feel secure and well-served.

Churn Analysis

Voluntary Churn Reasons

- Purchasing the Product: Some users eventually buy the products they need, reducing their dependence on rentals.

- Price Sensitivity: The cost of rentals, especially for mid-tier products, can be perceived as high for long-term users.

- Product Quality Issues: Any deterioration in product quality directly impacts user satisfaction and can drive churn.

- Logistical Issues: Delayed or faulty deliveries, as well as inconvenience in setup or return, are significant drivers of voluntary churn.

- Poor Style Selection: A lack of varied styles may deter users seeking more options.

- Poor Support: Subpar customer service can quickly erode user trust and satisfaction, especially for renters who face logistical or quality issues.

- Short-Term Use Cases: Customers with temporary rental needs (e.g., table, chair, water purifier for brief periods) are less likely to retain beyond the immediate use period.

Involuntary Churn Reasons

- Life Events: Major life changes such as relocating internationally, death, or marriage may lead users to churn regardless of service satisfaction.

Negative Action Indicators

To proactively identify at-risk users, we track the following negative actions that signal possible dissatisfaction or an intent to churn:

- Support Tickets: High volumes of support tickets indicate possible issues in logistics, such as delayed or broken products. Patterns in complaint types can further help pinpoint areas needing improvement.

- Low Net Promoter Score (NPS): A low NPS often signals dissatisfaction with the service or product quality, indicating that a user may not recommend Rentomojo to others.

- Declining Customer Satisfaction Scores (CSAT): Lower CSAT scores, especially in response to recent transactions or interactions, are predictive of churn. Tracking these scores can help detect dissatisfaction early and enable timely intervention.

Indicators of Churn

Negative Action | Reason |

High Cart Abandonment | Complicated KYC process, unclear next steps, or difficulty in understanding pricing and payment plans |

Low NPS or CSAT | Poorly timed survey (e.g., during core flows), long delivery times, subpar delivery experience, unreliable tracking, poor product quality, or improper installation practices |

Number of support tickets increase in last 30 days | Complicated KYC, unsmooth payment plans, lack of clear invoices, logistics issues, poor product quality, difficult-to-find relocation feature, and weak post-delivery support |

Removal of saved payment details | Can indicate voluntary or involuntary reasons, planning to switch services, or dissatisfaction with current service offerings |

Removal of auto-debit mandate from UPI | May indicate a future default risk due to personal reasons, user planning to cancel the service, or missed reminders due to disabled notifications |

Negative review on social platforms | Dissatisfaction with product quality, delivery experience, adherence to timelines, or installation support |

Payment Default or Non Payment of Rent | Personal reasons, missed due to deactivated auto-mandate, ignored reminders due to disabled notifications, or planning to switch services |

Decrease in the number of rented items: Earlier it was 5 now it is 3. | Reduction in quantity of items rented (e.g., from 5 to 3) could suggest service switch plans, product purchases, or personal reasons (both voluntary and involuntary) |

We can draw the following insights from the table:

- User Friction and Abandonment: Complicated KYC, unclear payment plans, and challenging navigation (e.g., relocation feature) lead to high cart abandonment, support tickets, and dissatisfaction.

- Negative Experiences Impact Satisfaction: Delays, poor delivery quality, difficult installation, and timing of surveys during key user flows contribute to low NPS/CSAT and increase the likelihood of negative social media reviews.

- Behavioral Cues Signal Churn: Actions like removing saved payment details or UPI auto-debit, decreasing rented items, or missing rent payments often indicate potential churn due to dissatisfaction, preference changes, or external personal reasons.

Resurrection Campaigns

We will run the following campaigns to address the churn reasons as identified above:

- Nudge KYC: This campaign aims to reduce cart abandonment by simplifying the KYC process, offering support through notifications and customer calls. Weekly nudges encourage first-time users to complete onboarding smoothly.

- Relocation Campaign: To retain users who are relocating, this campaign offers a relocation service to transfer rented items, along with support calls and a one-month free rent incentive. It targets users nearing subscription end dates.

- Repair Campaign: For long-term users, this campaign provides free repair and maintenance services after six months to enhance satisfaction and drive word-of-mouth referrals. Monthly reminders ensure ongoing engagement with high-value users.

- Add Auto-Debit Method: This campaign helps reduce late payments by encouraging users to enable auto-debit, offering a month’s rent off as an incentive. Monthly reminders target users with a tendency for last-minute payments.

- Missed A Payment: To prevent churn, this campaign addresses missed payments with reassuring prompts and support calls, waiving fees for first-time late payments. Twice-weekly reminders help retain at-risk users and minimize defaults.

Here is a detailed view of the campaigns.

Resurrection Campaign | Hypothesis | Channel of Distribution | Persona/Type of User | Theme | Target feature | Pitch and Content | Goal of the campaign | Details | Offer | Frequency and Timing | Success Metrics | Milestones for the campaign |

Nudge KYC | High cart abandonment and funnel drop-off due to complex KYC; nudging users can improve funnel movement. | Notifications (Pop-ups, Emails), Calls to interested users | Casual users, especially first-time app users or users interested in secondary products like cupboards, who may find KYC overwhelming. | Simplify the onboarding experience | KYC Process | “Onboarding is getting overwhelming? Don’t Worry our team will help on each step of the way” | Convert at-risk users into activated users | Customer support provides telephone assistance through each KYC step. | There is no offer here. | Weekly reminder to complete KYC, sent on Tuesdays (most productive day). | Reduced cart abandonment rate | 10,000 KYC assists in 3 months |

Relocation Campaign | Users often end subscriptions when relocating; offering relocation support can improve retention. | Notifications (Email, Pop-ups), Calls to those showing intent | Users with ending subscriptions who may be considering switching services but want to avoid onboarding hassles on a new platform. | Retain relocating users | Relocation Service | “Are you Relocating? Don't worry your furniture will follow you” | Once ending the subscription they can evaluate other options like switching to competitor or buying the product | Once a user opts in the customer support will provide assistance in the form of booking the relocation service. | If the user is relocating. They get one month of rent off. | Starts one month prior to subscription ending. Sent every week. | Increase in re-subscription rate | 1000 relocations completed in 3 months. |

Repair Campaign | Users who have been using a product for more than 6 months will face certain repair and maintenance issues. | Notifications - Email and Pop-Ups Call - To those users who have shown intent | These are core and power users who subscribe for longer periods of time, often 12-24 months. These users have a high potential of becoming a champion and spreading word-of-mouth. | To increase word-of-mouth | Repair/Maintenance Service | ‘Bed creaking? Give us a quick call’ | The users who are targeted already enjoy the core value proposition of the product. There is a lot of potential to drive word-of-mouth and referral in this user base. By giving these users more reasons to love the product we are reducing the probability of churn by improving their experience. | Once the users opt in for repair/maintenance a service professional visits and does on-spot repair work. | If the product is found beyond on-spot repair, it is replaced free of cost. | Starts once the six-month period is completed for a subscription. Sent every month for the rest of the subscription period. | Increase in referral rate | 1000 repairs completed in a 6 month period. |

Add Auto-Debit Method Campaign | A lot of users miss their rent payments because they forget to pay on time. This can be avoided if they add auto-debit methods. | Notifications - Pop-Ups and Email | These are casual users who have just been activated. They have made the payments on time, but always on the last dates of the cycle. This shows they have intent to pay on time but it is not on their immediate attention. | To reduce late payment and payment default rate. | Auto-Debit Service | “Never miss a payment and avoid late payment fees! Opt-in for auto-debit today.” | The goal is to make it easy for the users to pay their rents seamlessly and on time. This derives retention because the users do not have negative feelings of late payment fees or defaulter image attached to the product. | Once the user opts-in they are taken to the adding the auto-debut flow. | If the user opts-in they are given a month's rent off. | Starts two months after the subscription begins. Sent every month 2 days prior to the payment deadline. | Decrease in late payment / default rate. | 10000 auto-debit opt-ins in a 6 month period. |

Missed A Payment Campaign | A lot of users miss a payment and in the fear of late payment fees they uninstall the app and try to cut any ties with the product. | Notifications - Emails and Pop-Ups Call - To those users who are about to miss the second month as well. | These are casual users who have missed a payment and have decided to delay the late payment by avoiding the whole situation. | To bring back at risk users and prevent loss of inventory. | Late Payment Feature | ‘Missed a payment? Don't worry, we are here to help.’ | The goal of the campaign is to reduce the fear of late payment and reduce anxiety in the user base and therefore drive retention and word-of-mouth. | Once the user has missed a payment, they are prompted to finish the payment. If the prompts are not acted upon, calls are made. | If it is the first instance of late payment. The late payment fees is waived off. | Twice a week once the payment is late. Call once in two days after 10 notifications have been sent. | Decrease in payment default rates | 1000 late payment recoveries in 3 months. |

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.